For Week Ending August 18, 2018

It has been another busy summer for residential real estate. The lower supply, higher prices, faster sales mantra has remained in place for most of the nation for the entirety of the year – which heightened in intensity during the summer sales season – but there has been some conversation about the possibility of more supply and lower prices. Presently, it is just conversation, as the numbers are not reflective of a shift in trend lines anytime soon.

In the Twin Cities region, for the week ending August 18:

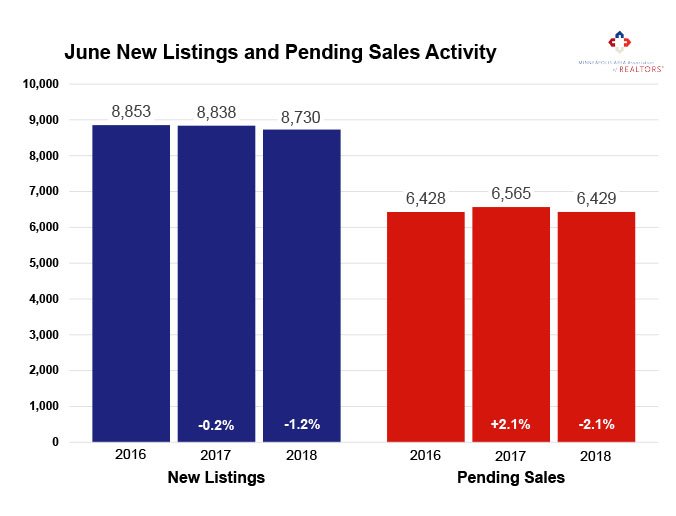

- New Listings increased 6.2% to 1,759

- Pending Sales decreased 10.2% to 1,215

- Inventory decreased 10.9% to 12,207

For the month of July:

- Median Sales Price increased 6.6% to $268,000

- Days on Market decreased 17.4% to 38

- Percent of Original List Price Received increased 0.7% to 99.8%

- Months Supply of Inventory decreased 11.1% to 2.4

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Licensed In Minnesota

Licensed In Minnesota